In the competitive landscape of modern business, understanding customer behavior is crucial for sustained growth and profitability. One of the most critical metrics for any company, especially those in the SaaS industry, is customer churn. Churn represents the percentage of customers who stop using a company’s product or service during a specific period. Measuring churn accurately is vital for several reasons, including financial stability, customer satisfaction, and strategic planning.

Financial Stability

Churn directly impacts a company’s revenue streams. For instance, if a company receives $1 million in revenue each quarter but loses $100,000 from departing customers, the overall churn rate is 25%. This loss must be factored into financial planning to achieve long-term goals.

High churn rates signify that the company is losing more revenue than it is gaining, which can destabilize financial health and hinder growth. Accurate churn measurement allows companies to forecast revenue more precisely and implement strategies to mitigate losses.

Customer Satisfaction and Retention

Measuring churn helps identify issues related to customer satisfaction. A high churn rate often indicates underlying problems such as poor customer service, lack of product value, or better offerings from competitors.

For example, Melissa Smith’s training company experienced stagnant revenues because they only tracked new customers against those lost, without understanding the revenue impact of churn. By accurately measuring churn, companies can pinpoint dissatisfaction sources and take corrective actions to improve customer retention.

Strategic Planning and Decision Making

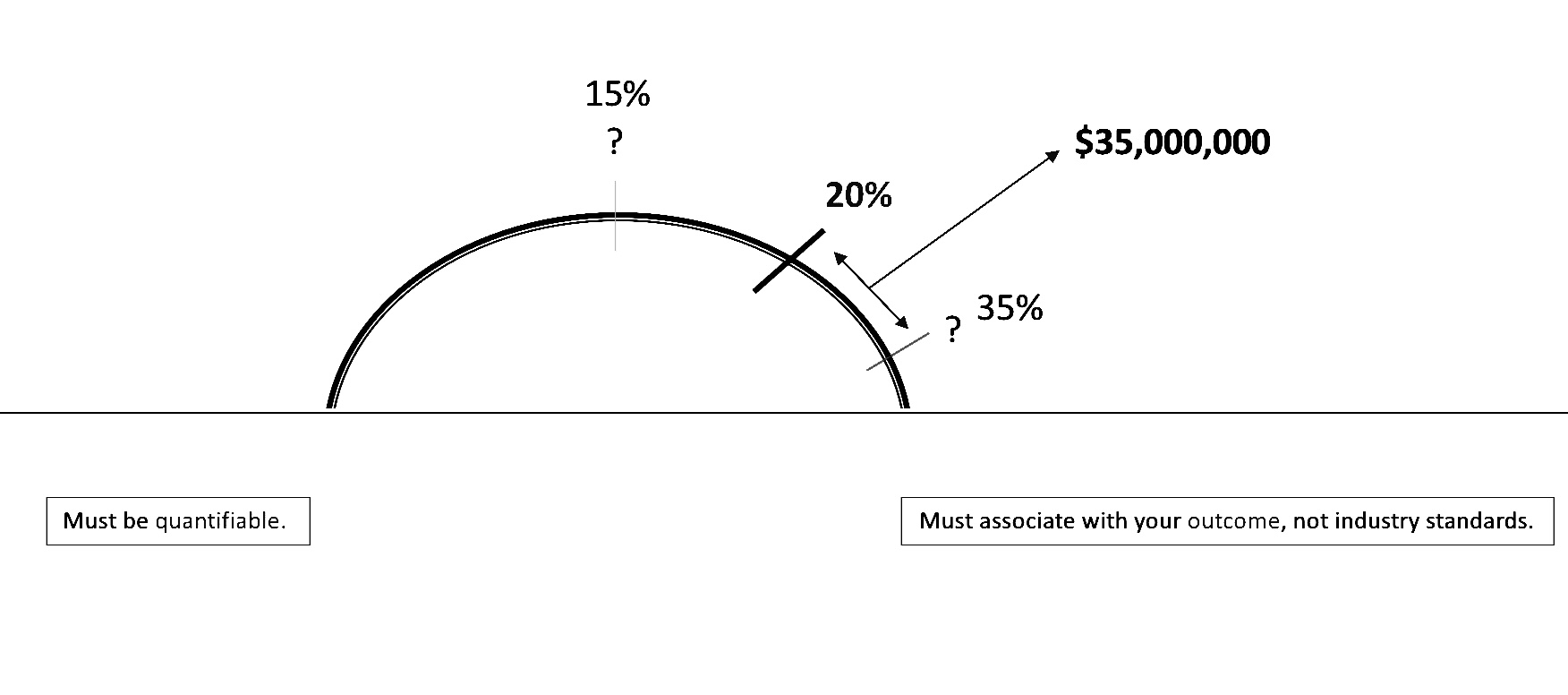

Accurate churn measurement informs strategic decisions and long-term planning. For instance, Betty’s company gained 15 clients but lost three clients who contributed significantly more revenue than the new ones, resulting in a negative revenue churn of -$75,000.

This scenario underscores the importance of not just tracking the number of customers but also the revenue they generate. Companies can use churn data to refine their marketing strategies, enhance product features, and improve customer engagement practices.

Optimizing Customer Acquisition Costs (CAC)

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) are critical metrics that interplay with churn. World-class SaaS platforms aim for a CAC of less than 33% of the customer LTV.

High churn rates can inflate CAC as more resources are needed to replace lost customers. By measuring churn accurately, companies can optimize their CAC, ensuring that acquisition efforts are cost-effective and contribute positively to overall profitability.

Enhancing Product and Service Offerings

Understanding churn patterns can provide insights into product and service shortcomings. For example, if a significant number of customers churn after a specific feature update, it might indicate issues with that update. Companies can leverage churn data to iterate on their offerings, ensuring they meet customer needs and preferences effectively.

Accurately measuring churn is indispensable for any company aiming to achieve and maintain world-class status. It affects financial stability, customer satisfaction, strategic planning, and operational efficiency. By understanding and addressing the factors contributing to churn, companies can foster a loyal customer base, optimize their resources, and drive sustainable growth. As the adage goes, “What gets measured gets managed.” Therefore, making churn measurement a priority can be a game-changer in today’s competitive business environment.

Understanding and managing churn is not just about keeping customers; it’s about building a resilient business that can adapt and thrive amidst challenges. By focusing on accurate churn measurement, companies can ensure they are on the right path to achieving their long-term goals and delivering exceptional value to their customers.

Finally, make sure you try Catipult.AI. It’s only $1 for 30 days… start your trial today.