Catipult AI Tranforms Your Investment & Financial Business

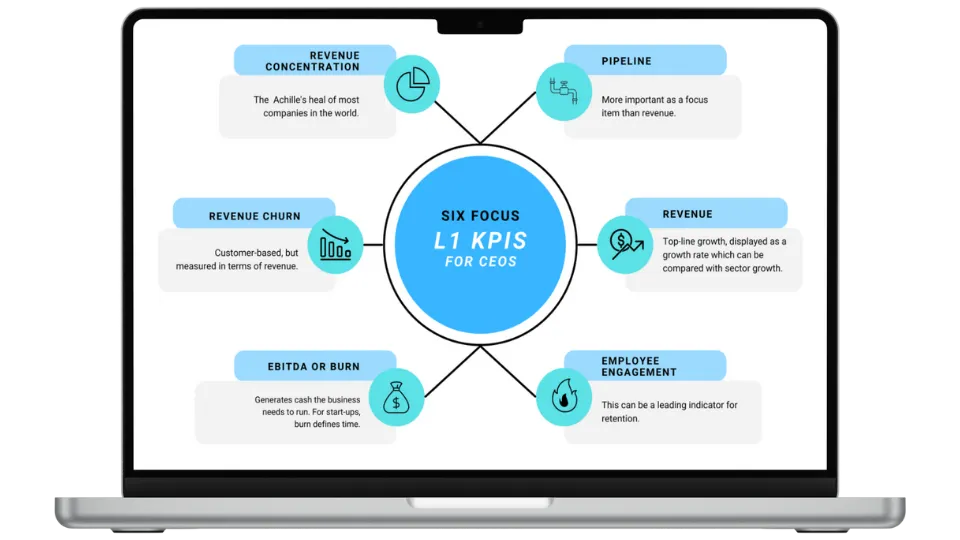

Elevate your investment firm operations with Catipult's AI-driven strategy. Our Valuation-First Methodology optimizes portfolio management, enhances client relationships, and drives sustainable growth, aligning every aspect of your firm with long-term value creation.